At the end of 2017, I was invited by the transformation office of National Bank of Canada (NBC) to help the organisation in building the new AI Team of the bank.

During this tenure, we worked and explored the application of many technologies : speech to text (experiments in 2018 to prepare introduction of the Verint platform), automatic translation (indoor experiments with open source technology to provide a securised automatic translation tool), experimenting with machine learning (ML) and Medalia applications to conduct opinion detection, and many others.

We also initiated and launched numerous key projects there that are now in production and have a real impact on customers and employees of the Bank.

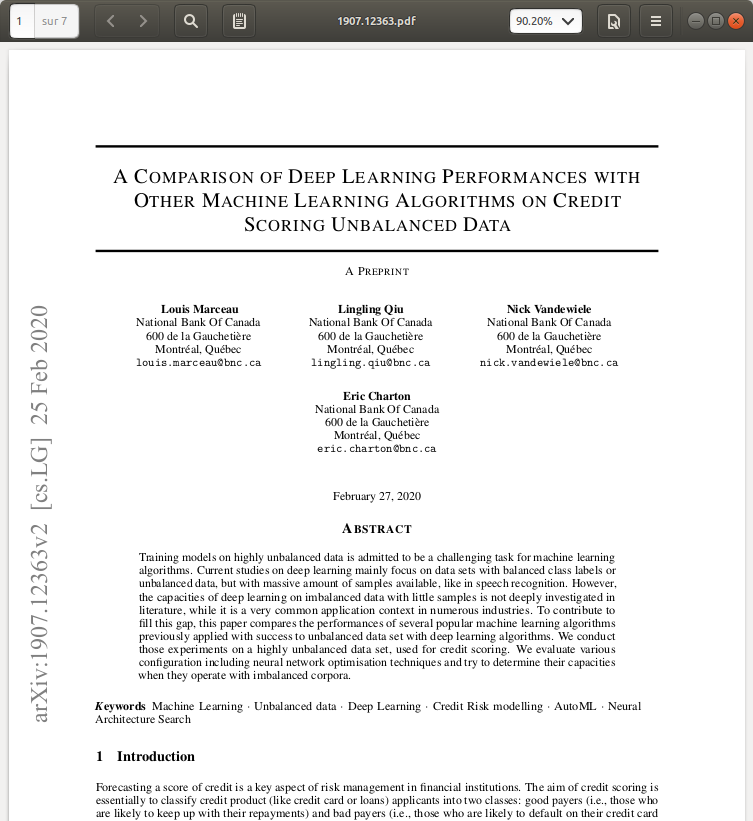

Machine Learning applied to credit modelling and pricing

From 2018, I built a small team to experiments on credit modelling. We specifically wanted to investigate how various categories of ML algorithms performed on credit scoring, including the new Neural Network Architecture optimisation techniques recently proposed (NAS). This research leaded to important findings, published in the paper A comparison of Deep Learning performances with other machine learning algorithms on credit scoring unbalanced data (this paper is currently one of the most cited in the narrow field of ML applied to credit scoring). The solutions we found are still now in production for credit behavior scoring at NBC.

We also worked on pricing optimisation methods based on machine learning (a technology initially developed to experiment on the pricing desk but that could be applied to many fields). This AI Technology is now object of a registered patent : Systems and Methods for Autromatic Pricing Desk Operations. This patent is the first of the history of NBC to be registered in USA (and we are very proud of this !).

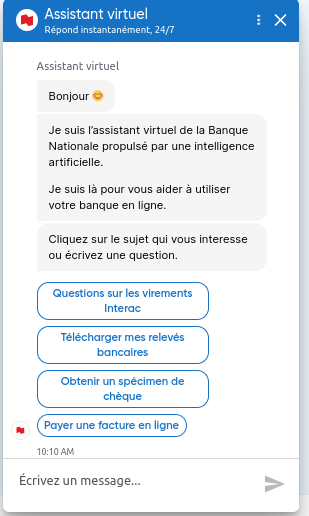

Dialog Systems

At the very beginning we proposed to the bank a strategy to industrialise at scale a dialog (chatbot) capacity based on deep learning techniques. The idea was to be able with agility and at low cost to deploy bots in many business units. To do so we integrated a dialog platform based on the open source framework Rasa. We included many innovations in this platform (we published papers and submitted a patent). This platform is now (2023) used to power and standardise nearly all the conversational assets of the bank (those on bnc.ca, bncd.ca uses it) and also, internally, to support the employees (Natbot is the internal bot and uses our platform). We also extended the bot platform capacity to process emails, making it able to answer around 10% of the mails sent by customers trough their online banking service.

11 bots were built in the organisation from 2020 to 2023 using this platform, making it a unique way to use the dialog technology in finance industry in north America ! I presented the strategy and the technology in numerous international conferences.

It was measured that those conversational agents reduced substantially the load on call centers and were able to demonstrate a substantial ROI.

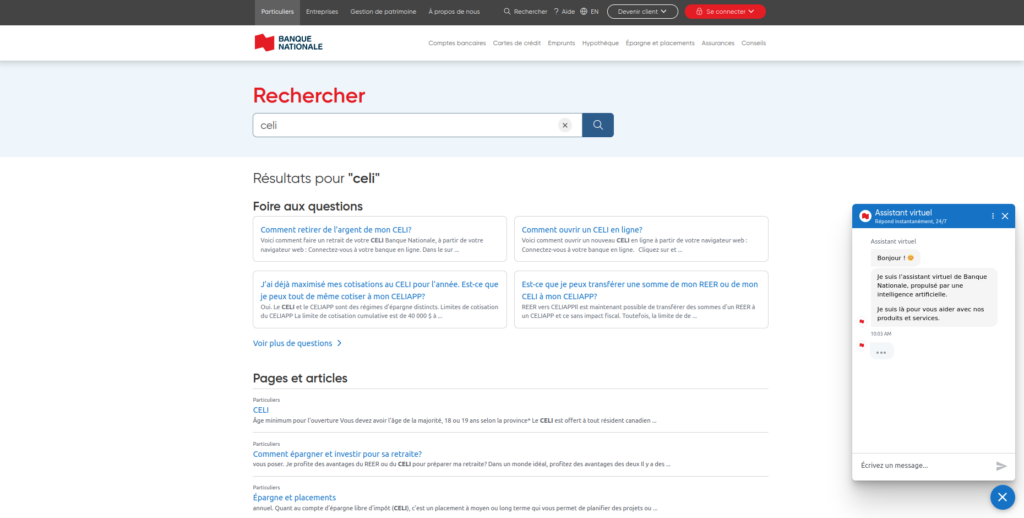

Search engine

We built a state of the art help center. Our mission was to help to design a new help section for the bank customers using every available AI technologies. First we designed an aggregated search engines able to both handle natural language queries (eg. ‘How do I open an RRSP’) and classical keyword queries. This search engine is now able to answer properly over 90% of questions : a reference in the industry. We also integrated in the help center a specific chatbot (with fine tuned model for this specific context). This chatbot is capable to correctly answer more than 80% of question, again a reference in the industry.